Understand your payslip and the French salary

Salaire brut/Net/chargé: what’s that supposed to mean?

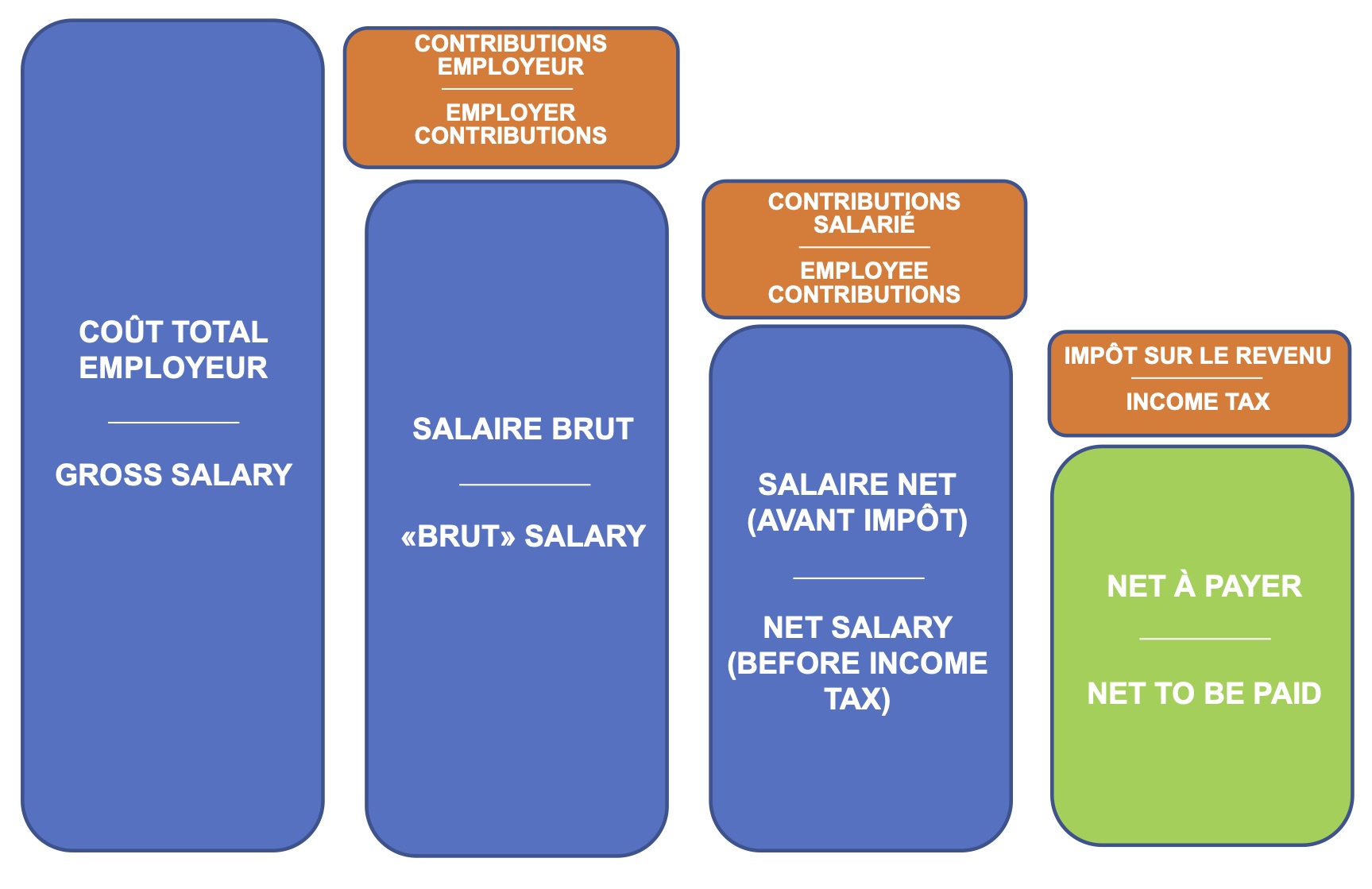

Salarie chargé = Total to be paid by the employer. It is the global salary cost for the employer (gross salary + employer contributions)

Salaire brut = Gross Salary. The gross salary represents the amount due to the employee under the terms of his/her employment contract, before any mandatory tax deductions. The gross salary includes the remuneration of his/her actual working hours, as well as different commissions or bonuses. It also takes into account sick leaves, paid leaves or bank holidays.

Salaire net avant impôt sur le revenu = Amount to be paid before income tax.

PAS or Prélèvement à la Source = Income tax deducted at source/Withholding tax

Salaire net : Net salary. The amount paid to the employee by the employer. It is obtained by deducting the amount of income tax from the amount to be paid before income tax.

The French payslip

- What is a Payslip?

In France, a pay slip is a document provided by the employer proving the salary paid to the employee. It details the net salary paid and the social part of the salary via various contributions (retirement, sickness, provident, unemployment, training, CSG, etc.).

- When is the Payslip due?

The payslip must be given to the employee at the time of payment of the remuneration, which must take place at least once a month. The employee must keep their payslip order to exercise pension rights.

- Is there a unique Payslip model?

There is no official salary slip template. The forms therefore vary according to the companies in charge of payslip preparing.

While already existing payslip models are widely used in practice, the law does not impose a standard model. On the other hand, it does impose mandatory statements that must in all cases be mentioned on the document given to the employee.

- How is the Payslip delivered?

The payslip is usually sent to the employee by post or delivered directly by hand against a receipt. It can also be sent in the form of an electronic pay slip, the employee nevertheless retaining the right to refuse this dematerialization.

- In my payslip there is taxable net and net payable. What is the difference ?

The net salary to be paid is the amount the employee receives after deducting all social security contributions….. The net taxable salary differs from the net salary to be paid because all social contributions, which are payable by the employee, are not deductible for the calculation of income tax.

- What is the withholding tax « Prèlèvement à la source » PAS

The withholding tax came into effect on 1 January 2019. Income tax is now deducted directly from the payroll of employee taxpayers.

The employees’ pay slip indicates the basis and rate of the withholding tax, the amount paid as well as the amount of the salary that would have been paid before the withholding tax. This net salary before tax is indicated in large print on the pay slip (1.5 times larger than for the other lines).

- How can I change the PAS rate on my Payslip?

If the employee wants to change his withholding tax rate, he should not contact his employer, but the tax authorities. The steps are accomplished by accessing his space on the tax site.

- I have never worked and it’s my first Payslip, what is the applicable PAS rate?

An employee who starts work and has never filed an income tax return is automatically charged the neutral withholding tax rate, which corresponds to the rate normally applicable to a single person and is calculated only on the basis of the salary alone.

When you subscribe to the blog, we will send you an e-mail when there are new updates on the site so you wouldn't miss them.